-

31/08/2016

-

2353NM

-

debt and deficit

After a year of saying that he could get the Federal Budget back into surplus, seemingly by just cutting support to the less well off in our society, Treasurer Scott Morrison finally realised something any school child who has started business studies classes would be well aware of — a balance sheet comprises debits and credits.

Morrison was speaking to the Bloomberg Economic Summit in Sydney last week. Apart from the usual claims of deliberate obstruction from the Opposition, there was an acknowledgement that ‘Deficits have proven difficult to shift in recent years, despite applying significant

expenditure controls’.

Taxing more, which is apparently different from ‘protect[ing] the revenue base from structural weakness’, has been ruled out. That still allows measures such as enforcing GST payments on low value imports (such as the shopping you and I do over the internet), attempting (apparently again) to ensure that multi-nationals pay tax before shipping profits overseas and looking at ‘the way generous tax concessions are provided in the superannuation system’.

We even got a new (sort of) three-word slogan to illustrate how serious Morrison is: the ‘taxed and the taxed-nots’. Morrison correctly makes the claim that a lot of Australians have not experienced a recession in their adult lives or unemployment rates of over 10%. The jury is still out on the effectiveness of the ‘taxed and taxed-nots’. Probably the gold standard here is now Ambassador Joe Hockey’s ‘lifters and leaners’: while it was an effective slogan as people remember it, Hockey’s period as treasurer was noted only for an increase in the government’s debt and the infamous 2014 budget which still hasn’t passed parliament in its entirety.

Hockey and Morrison point the finger at the ALP for holding up savings measures in the Parliament. Most of the measures held up in the Parliament are spending measures because as

Peter Martin reported:

As he [Morrison] puts it, "you don't encourage growth by taxing it more". Of course, withdrawing spending doesn't help much either, but to him it's a lesser evil.

Of the $40 billion in budget measures yet to be passed, more than 60 per cent constrain spending. Only a third, $15 billion, boost revenue.

The two big claims are that more Australians receive more in government benefits than they pay in tax and Australia (the government) will owe $1trillion to others in the near term should action not be taken immediately. Let’s look at the claims.

It’s probably a fair statement to suggest that about half of the population pay no nett tax. At least it was a couple of

years ago. The architect of the current taxation and welfare systems, Howard era treasurer Peter Costello wrote an opinion piece in the

Daily Telegraph a year or so ago which to an extent justifies his reasons:

Sometimes tax reforms involved lower income earners paying more — like the introduction of the GST — but we were always clear that the welfare system could be used to compensate for that. The welfare system is the way to redistribute income. That is not the role of the tax system. The tax system is there to raise revenue at the lowest cost in the most efficient way doing the least damage to the economy.

If you try to use both the tax and the welfare system to redistribute income you get punishing rates of income withdrawal as a person’s income rises. This is called the effective marginal tax rate (EMTR). As people lose benefits and pay higher taxes they can lose 60, 70 per cent, sometimes 100 per cent of every extra dollar they earn. This creates a huge disincentive to work. It creates poverty traps. And, it heightens the incentive to “hide” additional income.

And Costello has a point — the tax system is there to raise revenue at the lowest cost and do the least damage to the economy. If there is a need to return funds to a section of the community due to adverse circumstances, it is far easier to do so using targeted welfare, rather than arranging for exemptions and conditions in the taxation system. We could discuss the inequity in Costello’s targeting until next week if we wanted to but the professionals, such as

The Australia Institute might have a better understanding.

According to

The Australia Institute, Peter Costello’s actions during the ‘once in a lifetime’ mining boom was to:

… cut taxes so far and so fast that they forced the Reserve Bank of Australia to rapidly increase interest rates.

While countries like Norway took the benefits of resource price booms and banked them in their sovereign wealth fund, Peter Costello chose to cut taxes for the wealthy instead. He knew at the time that his populist generosity to the highest income earners would force future treasurers to choose between budget deficits or cutting spending on the sick, the poor and elderly. No prizes for guessing which our former treasurer prefers.

The only thing Peter Costello hates more than budget deficits is collecting the revenue needed to fix them. Just as his government did nothing about the long term challenge of climate change, his government did nothing to set up Australia's long term public finances.

If you want to, you can wade through the IMF’s report of government waste and profligacy released in January 2013

here or you can just take

The Saturday Paper’s word for it that generally Australia was judged well except for four periods — the two largest under the stewardship of Howard as prime minister and

Costello as treasurer (partial paywall).

Howard and Costello were buying votes. It’s an easy sell to suggest that if you support my re-election campaign, I’ll give you money back in additional benefits or reduced taxes. As

The Australia Institute suggests:

For the record, here are 5 of Treasurer Peter Costello’s most ‘profligate’ and inequitable decisions, which created the structural deficit inherited by his successors;

1. Income tax cuts, primarily for the rich, during the boom. Worth $37.6 billion or $26.4 billion if you exclude bracket creep in 2011-12

2. Capital gains tax discount. Worth $5.8 billion in 2014-15

3. Got rid of fuel excise indexation. Worth $5.5 billion in 2013-14

4. Superannuation tax cuts. Worth $2.5 billion in 2009-10

5. The decision to convert 'franking credits' into cash refunds for shareholders

They have given an explanation why each of the cuts has been incredibly bad value to the economy — go to the article to see them.

In some ways it is a delightful irony that the Coalition treasurers of the ‘twenty teens’ are having difficulty in politically justifying the spending cuts they believe are necessary to achieve their economic aim. Which leads us on to ‘message two’ as recently promoted by Morrison — Australia’s debt will hit a $1 trillion if nothing is done.

news.com.au breathlessly reported last week that Morrison’s statement to the Bloomberg Economic Summit would blow out to $1 trillion within the next 10 years if the government doesn’t get its budget savings through the parliament. Of course, according to Morrison anyway, this is the ALP’s fault and, while it is admitted that the figure is the ‘worst case scenario’, the implication is that Keating’s ‘Banana Republic’ would have nothing on the resulting recession.

Apparently, a trillion looks like this; 1,000,000,000,000. Australia’s annual GDP (our income before expenses) is currently around $893billion (or $893,000,000,000) according to the Parliament of Australia’s

website. While all debt does have to be repaid at some point there is bad debt and good debt — a nuance that seems to be lacking in the current political debate.

Bad debt in the case of the government is where they are borrowing money to pay for recurrent items such as wages, the cost of stationery or similar items. To bring it back to a domestic level, if you were to go to the supermarket and petrol station each week and get your groceries and fuel on the credit card while only repaying the minimum amount due, two things would eventually happen: the first is that you would hit the credit limit of the card and the retailers would not accept any further charges; and two, the cost of the groceries and fuel you had already consumed would rise exorbitantly as the usually high interest on the purchases made on a credit card would continue until the debt was repaid in full (together with the interest).

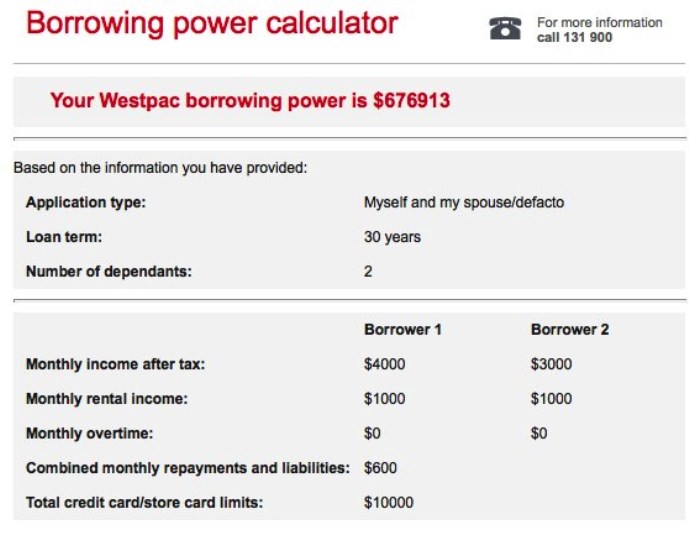

Good debt is something else again. Governments borrow money for capital works and long term investments. Again bringing it down to a domestic level, if you borrow money to purchase a home to live in, depending where you live in Australia you are entering a contract with a financial institution for them to loan you considerably more than you can possibly earn in a year. Here’s an example using Westpac’s ‘How much can I borrow’ calculator for a couple with two dependent children.

Borrower 1 earns around $60,000 per annum and Borrower 2 earns around $45,000 per annum and they have some expenses. If you assume that they have a 20% deposit they would probably be in the market for a property priced around $800,000 to $900,000. To save time, we’ll leave the discussion on what they can/should buy and where to the property websites and TV shows. The point here is that between our two borrowers, their joint income is around $100,000 per annum. The Westpac borrowing calculation is really saying that to purchase a home, they can borrow about seven times their annual income and in parts of Australia, they will need every cent of it.

If our mythical borrowers were contemplating borrowing up to seven times their annual income no one would blink an eyelid, as buying a home is ‘good debt’ and the ratio of around 7 to 1 hasn’t changed for decades.

What we have yet to establish is if the potential government $1 trillion debt is good debt or bad debt. Last Sunday on our

website we observed that of the $37 billion in additional debt Australia had placed in the 2016 budget, $36 billion of it was for capital works. Generally capital works are an improvement to a particular site that generates income in some way — either directly (say the construction of a new factory to house a production process) or indirectly (improving people’s quality of life by putting a roof over their head for the long term). Just like buying a home, capital works is generally good debt for government, provided we can meet the repayments, as it improves the amenity of our society through more efficient transport connections, better communications or increased services to the community.

Morrison’s recent speeches on debt and disaster therefore are duplicitous on two levels: while the ALP certainly didn’t clean up the overly generous welfare system, neither did they create it (if anything the ALP and the Greens are trying to inject some fairness into the changes blocked in the 2014 and subsequent budgets so the better off ‘feel the pain’ as well); and if a bank will lend our hypothetical ‘borrower 1’ and ‘borrower 2’ nearly seven times their annual income to purchase a capital item (a home to live in), why is there so much concern about Australia’s borrowings potentially getting to a value slightly over one year’s income or GDP (prior to deductions) in around 10 years’ time?

The problem with all this is that Morrison is claiming a debt of $1 trillion will send this country into a recession like we have never seen before. Who knows, it may — but the chances are pretty remote. The more probable alternative is that our society shares the output from the borrowing by our government and the resultant economic benefits. The economic benefits of the better road, rail line or telecommunications infrastructure makes money for the businesses and individuals who use it, who then earn more and pay more tax giving the government the resources to repay the original debt.

Morrison is half way on his ‘

road to Damascus’ in that it recently seems to have ‘clicked’ that alterations to the revenue side of the Australian budget are just as necessary as his and his immediate predecessor’s fixation with the expense side of the ledger to the detriment to those on lower incomes. Now he just needs to understand that there are different types of debt; and some of them are actually good for our society.

Current rating: 0.4 / 5 | Rated 14 times