The spectre of trickle down economics continues to haunt the political landscape, emerging again and again like a ghostly zombie from a dark, damp cave where it quietly moulders, refusing to die, always ready to be summoned by a believer.

Not often is the term ‘trickle down’ uttered, and when it is, it is by opponents of the concept. Instead, the proponents tell us that giving tax cuts to the top end of town will benefit those at the bottom through more jobs and better wages.

At his National Press Club address at the beginning of February, PM Turnbull again cited his plan for tax cuts to business as central to the rejuvenation of the economy, to increased competitiveness, and to the creation of more jobs and better pay for workers. Scott Morrison has been harping on this theme for months as he pushes the government’s proposed 50 billion tax cuts to business.

Donald Trump is singing from the same song sheet. He plans to stimulate job growth through massive cuts to corporate tax, reducing it to 15%, and simplifying and lowering personal tax.

In other words, these leaders are gambling on trickle down economics doing the job.

What is the truth about this longstanding economic device? Unfortunately, in this post-truth era, in this weird phase of ‘alternative facts’ the ‘truth’ is whatever one wants it to be; words can mean whatever you want them to mean, Humpty Dumpty style, or should I say Kellyanne Conway style?

For months now, I have been researching ‘trickle down economics’, sometimes known as ‘supply side economics’, a term preferred by advocates who feel offended by the more pejorative term. I have read dozens of articles from many sources.

My conclusion is that political ideology is the most significant determinant of the attitude politicians have to the trickle-down concept. Conservatives are more likely to be believers; progressives more likely to be skeptics.

There have been several pieces on

The Political Sword on this subject over the years: In April 2011, after the publication by Queensland University’s professor of economics, John Quiggin, of his book

Zombie Economics: How dead ideas still walk among us (Princeton University Press, 2010), there was a

TPS piece:

Joe Hockey should read John Quiggin’s Zombie Economics. Quiggin’s exposé was about how discredited ideas in economics don’t die, nor are they alive, they are simply ‘un-dead’ – zombie like. Here is an abbreviated account of what that piece had to say about trickle down economics:

"Trickle-down economics is an idea that whatever benefits are given to the wealthy, they will filter down to the poorest…As long as there have been rich and poor people, or powerful and powerless people, there have been advocates to explain that it’s better for everyone if things stay that way. While great economists such as Adam Smith, John Stuart Mills and John Maynard Keynes have supported income re-distribution through progressive taxation, and most economists still do today, there are still some who argue that we should let the rich get richer and wait for the benefits to trickle down to the poor.

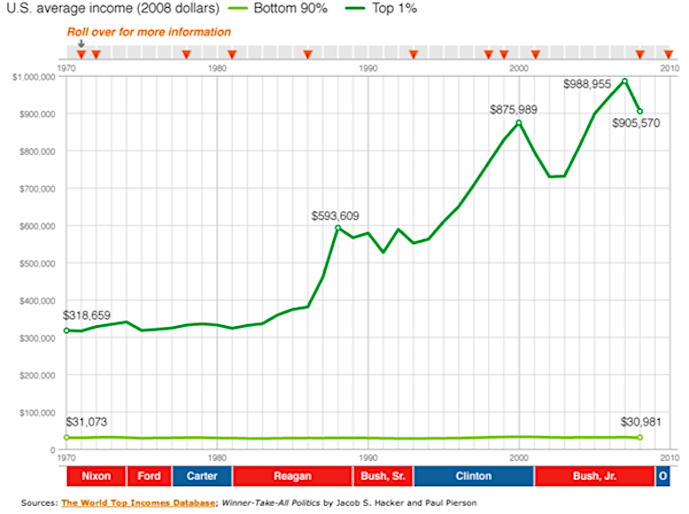

“Quiggin gives example after example showing the trickle down hypothesis is false, and caps this with a telling graph of household income distribution in the US from 1965 to 2005 that shows that those on the 95th percentile for income steadily improved their position by over fifty percent, while those on the 20th percentile and below were static. Here is another graph of incomes in the US for a similar period - from 1970 to 2010:

“Quiggin points out that the biggest challenge of the failure of the trickle-down hypothesis is to understand why and how inequality increased so much under market liberalism, and how it can be reversed.”

Increasing inequality is perhaps the most serious outcome of applying trickle down economics.

In April 2015 there was

The trickle down effect, that, among other things, described the differing approaches of the governors of adjoining states, Minnesota and Wisconsin, to workers’ wages, and showed that rather than boosting the wealthy, giving a proper basic wage to workers had a more positive effect on the state economy. This is sometimes described as ‘middle out’ economics that proposes that the most potent driver of an economy is the spending power of the middle class, not the upper class. You can read about this

here and

here.

'Middle out economics’ is more likely to diminish inequality, whereas ‘trickle-down’ increases it.

In May 2016 there was another:

Trickle down economics breeds inequality that emphasized the way in which trickle down accelerated inequality.

For anyone seeking to explore the history of

Trickle-down economics, Wikipedia gives a good account. Here is an abbreviated version of the Wikipedia entry.

It may surprise you to learn that the trickle-down concept dates back to 1896, when Democratic Presidential candidate William Jennings Bryan used the metaphor of a ‘leak’: “

There are two ideas of government. There are those who believe that if you just legislate to make the well-to-do prosperous, that their prosperity will leak through on those below. The Democratic idea has been that if you legislate to make the masses prosperous their prosperity will find its way up and through every class that rests upon it.”

The economist John Kenneth Galbraith noted that ‘trickle-down economics’ had been tried before in the United States in the 1890s under the name "horse and sparrow theory." … “

If you feed the horse enough oats, some will pass through to the road for the sparrows.”

It was humorist Will Rogers who first referred to the theory as ‘trickle down’ policy.

Since 1921 the dominant philosophy in Washington has been that the object of government was to provide prosperity for those who lived and worked at the top of the economic pyramid, in the belief that prosperity would trickle down to the bottom of the heap and benefit all. The first known use of ‘trickle-down’ was in 1944, while the first known use of trickle-down theory was in 1954.

The ideological divide between believers in trickle-down and non-believers is captured in the words of Lyndon B. Johnson, a Democrat, who alleged that

"Republicans simply don't know how to manage the economy. They're so busy operating the trickle-down theory, giving the richest corporations the biggest break, that the whole thing goes to hell in a hand basket.”

In 1992, Republican Senator Hank Brown said,

"Mr. President, the trickle-down theory attributed to the Republican Party has never been articulated by President Reagan and has never been articulated by President Bush and has never been advocated by either one of them. One might argue whether trickle down makes any sense or not.” That sentiment prevails! ‘Trickle-down’ is not often articulated, but its

modus operandi, tax cuts to the wealthy, is.

Here are some more excerpts from

Wikipedia:

In the 1992 presidential election, Independent candidate Ross Perot called trickle-down economics ‘political voodoo’. In New Zealand, Labour Party MP Damien O'Connor called trickle-down economics "the rich pissing on the poor". A 2012 study by the Tax Justice Network indicates that wealth of the super-rich does not trickle down to improve the economy, but tends to be amassed and sheltered in tax havens with a negative effect on the tax bases of the home economy.

In 2013, Pope Francis referred to trickle-down theories in his Apostolic Exhortation Evangelii Gaudium with the statement: "Some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system.”

If the income share of the top 20 percent (the rich) increases, then GDP growth actually declines over the medium term, suggesting that the benefits do not trickle down. In contrast, an increase in the income share of the bottom 20 percent (the poor) is associated with higher GDP growth.”

If the income share of the top 20 percent (the rich) increases, then GDP growth actually declines over the medium term, suggesting that the benefits do not trickle down. In contrast, an increase in the income share of the bottom 20 percent (the poor) is associated with higher GDP growth.”

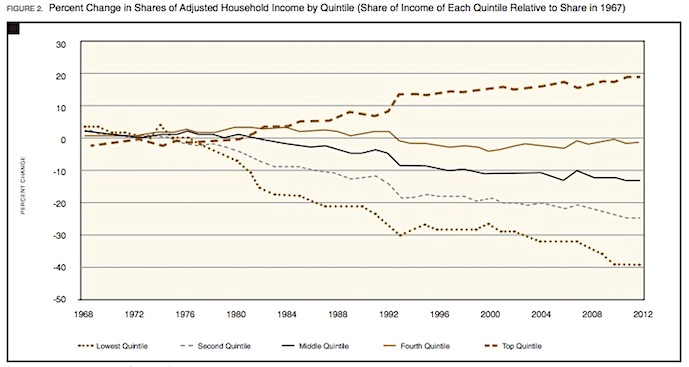

A 2015 report on policy by economist Pavlina R. Tcherneva described the failings of increasing economic gains of the rich without commensurate participation by the working and middle classes.

In the 2016 US presidential candidates debate, Hillary Clinton accused Donald Trump of supporting the ‘most extreme’ version of trickle-down economics with his tax plan, calling it "trumped-up trickle-down."

Trickle-down has a long and continuing history!

Let’s look now at a few more expositions on trickle-down.

You might like to start with a short 2014 article by Kathleen Miles from

The Huffington Post:

Next Time Someone Argues For 'Trickle-Down' Economics, Show Them This that has a telling graph. It addresses a favourite saying of conservatives:

A rising tide lifts all boats, and after providing salient facts, concludes: “

a rising tide has lifted a few big boats and washed the rest aside. Note how well the top 20% are doing compared with the bottom 20%.

Next, try this one from 2015:

Trickle down economics is wrong, says IMF. It begins:

Adding another nail to the coffin of Reaganomics, a recent study published by the International Monetary Fund (IMF) has concluded that, contrary to the principles of “trickle-down” economics, an increase in the income share of the wealthiest people actually leads to a decrease in GDP growth.

“The benefits do not trickle down,” the authors of the study write, directly contradicting the theory that US president Ronald Reagan popularized in the 1980s. Reagan argued that decreasing the tax burden for the rich investors, executives, corporations and the like, would not only increase their own income but stimulate broad economic growth as they create opportunities for others’ increased prosperity…

“But the IMF study’s five authors say we should instead focus on raising the income of the poor and the middle class. “Widening income inequality is the defining challenge of our time,” they write. “In advanced economies, the gap between the rich and poor is at its highest level in decades.”

“Raising up the poor appears to have a dramatic effect: A 1% increase in the income share of the bottom quintile results in a 0.38% increase in GDP. Meanwhile, a 1% increase in the income share of the top 20% results in a 0.08% decrease in GDP growth.”

This article highlights perhaps the most damaging effect of the application of trickle down economics – increasing inequality of income and wealth.

For those who need a more detailed appraisal, try

How Trickle-down Economics Works, first written in 2008 by Jane McGrath and reproduced this year. After six pages of informative analysis the article concluded:

“Trickle-down economics remains highly controversial. Recently, George W. Bush faced harsh criticism for his tax cuts. Despite staunch political opponents to trickle-down policies, some maintain that the general consensus among economists today is that the theory works. Nevertheless, you'll still find plenty of controversy surrounding trickle-down economics among politicians. Many, including Barack Obama, contend that it failed. During a hurting economy, Obama won the support of voters by promising to tax the wealthy and ease the tax burden on the lower-income bracket. So as of 2008, the tide of public opinion certainly shifted away from supply-side thinking yet again. Time will tell if opinion will shift back again."

For a contemporary view, try this article:

Can Trump make 'trickle-down' economics work? by Paul Davidson in

USA Today. It concludes: “

Mark Zandi, chief economist of Moody’s Analytics, says tax cuts do lead to stronger investment and job growth, but those benefits “are generally overstated.” He says they “do not pay for themselves” through additional tax revenue, citing the ballooning national debt during Reagan's term. That doesn’t mean slicing business taxes doesn’t have advantages. Harvard Business School professor Michael Porter says lowering the corporate tax rate – highest among advanced economies – would make the USA more competitive as a location for multinationals.”

Sounds familiar doesn’t it?

There are many more I could quote, some supporting, some denigrating trickle down economics, but enough is enough. What can we conclude?

The evidence is that giving tax breaks to business DOES work – their competiveness does improve. Giving tax breaks to the wealthy DOES work – they become wealthier. What the proponents of tax cuts won’t concede though is that the benefits of these tax cuts DO NOT trickle down to those at the bottom.

The evidence about the trickle-down effects of tax breaks has not been subject to rigorous appraisal. Those supporting it select facts and figures that prop up their case, as do those refuting it. Seldom does one read a well-balanced appraisal.

Economics is complex. There are many variables. It is not possible to control for all except one, or even a few. So where trickle down seems to have provided benefits to the economy, other factors have been operative, as was the case in Reaganomics.

In my view, the evidence is STRONGLY AGAINST the benefits of tax cuts for the top end of town trickling down to lower income earners in the form of more jobs and better wages. The touted benefit of trickle-down for those at the bottom has all the hallmarks of a fraud. Bernie Sanders says the same. I know though that most conservatives would disagree.

Finally, we ought not to expect a sudden change in economic thinking. In the field of science, a theory is tested continuously against accumulating contrary evidence until it finally overwhelms the theory, whereupon a ‘paradigm shift’, as described by Thomas S Kuhn in his book

The Structure of Scientific Revolutions occurs, the theory is discarded and is replaced by a more plausible one. In my view, that will not occur with the trickle-down theory. Economics seems unreceptive to paradigm shifts.

We can expect that conservatives will continue to promote the merits of trickle down economics (but not in those words), and will continue to implement its basic instruments – tax cuts for the top end of town and the wealthy – satisfied that benefits will trickle down to those at the bottom of the heap, a position that aligns with their ideology and their positive orientation towards those at the top, most of which are their supporters.

Progressives will argue the opposite, pointing to the undeniable evidence that the net effect of the application of trickle-down is to steadily increase inequality in income and wealth between those at the top and those languishing at the bottom. This is the most dangerous and damaging outcome, as widening inequality fosters discontent, discord, social disruption, and when extreme, revolution.

Facts, figures, reason and logic are of no value in this debate. Those whose political ideology is conservative will continue to believe in and apply trickle down economics; those whose ideology is progressive will continue to oppose it. There will never be agreement. The impasse is incapable of resolution. So we had better get used to it!

Current rating: 5 / 5 | Rated 1 times