-

13/04/2016

-

Ad astra

-

Royal Commission

‘Inequality’ is a term used by economists. Joseph Stiglitz has been writing for years about its damaging effect. His book:

The Price of Inequality is a classic. More recently, Thomas Piketty entered the arena with his

Capital in the Twenty-First Century and hypothesised about the genesis of inequality. He asserted that the main driver of inequality, namely the tendency of returns on capital to exceed the rate of economic growth, today threatens to generate extreme inequalities that stir discontent and undermine democratic values. He reminded us that political action has curbed dangerous inequalities in the past and could do so again. But is anyone listening?

No matter who writes about inequality, the conclusion is the same: the gap between those at the top and those languishing at the bottom of the pile is widening in many countries, ours among them.

A more familiar way of talking about inequality is to talk about ‘fairness’, a concept every Aussie understands. The ‘fair go’ is valued by most of us. Who would argue against the idea that everyone should have a ‘fair go’?

So look out for emphasis on fairness during the election campaign. You will hear it from Bill Shorten and Labor people; you might not hear much about it from LNP people, although PM Turnbull has often insisted that whatever changes his government makes to the tax system, they must be ‘fair’. We are still waiting to see his version of fairness. Although aware of the angry reaction of the people to the unfair 2014 Abbott/Hockey Budget, he is still seeking approval of many of the elements of it in the Senate. Treasurer Morrison does not seem to have 'fair' in his vocabulary.

Have you noticed that ordinary people are becoming increasingly fed up with the inequality we see day after day where those at the top of the pile gain advantages over those at the bottom? In the past few weeks we have seethed as we saw instance after instance of this. More of this later!

If you question whether inequality really is a problem in this country, take a look at these statistics, which are based on a 2015 ACOSS study:

Inequality in Australia: a nation divided:

• Inequality in Australia is higher than the OECD average.

• A person in the top 20% income group has around five times as much income as someone in the bottom 20%.

• There is an urban and regional pattern to income inequality, with people in capital cities more likely to be in the top 20%, while those outside capital cities are more likely to be in the bottom 20%.

• Wealth is far more unequally distributed than income. A person in the top 20% has around 70 times more wealth than a person in the bottom 20%.

• The top 10% of households own 45% of all wealth, most of the remainder of wealth is owned by the next 50% of households, while the bottom 40% of households own just 5% of all wealth.

• The average wealth of a person in the top 20% increased by 28% over the past 8 years while for the bottom 20% it increased by only 3%.

In other words inequality is steadily increasing.

If you need more evidence, read the 2014 study by The Australia Institute:

Income and Wealth Inequality in Australia by David Richardson and Richard Denniss.

While everyone concedes that the rich are steadily getting richer, conservatives salve their consciences by insisting that ‘all boats rise with the tide’ as prosperity increases, a convenient but false metaphor that implies that as those at the top get richer, so do those at the bottom, and at the same rate. Whilst it is true that all boats rise equally with the tide, it is not true that the poor get richer at the same rate as the rich. Study after study over many years show that while in good times the poorer do get richer, they do so at a much slower rate than the rich. Thereby the gap between rich and poor widens and inequality rises. Conservatives still believe in the old trickle down effect, although it’s long since been debunked as fiction.

It has always been the case that while the rich get richer, the poorest have lagged at the back of the pack wallowing in poverty. Many of the revolutions over the centuries have been the tragic outcome of this inequality.

Les Miserables tells this story poignantly.

Inequality results in social unrest, social disruption, and in the end, if unresolved, in revolution. It is a risky state of affairs. And the people are revolting against it.

Inequality results in social unrest, social disruption, and in the end, if unresolved, in revolution. It is a risky state of affairs. And the people are revolting against it.

Read what Nick Hanauer had to say in 2014 about the dangers of increasing inequality in:

Politico: The Pitchforks Are Coming… For Us Plutocrats

In the US, Bernie Sanders has attracted massive grassroots support by railing against income inequality. In contrast, conservatives embrace inequality. A 2014 article in

newmatilda.com by clinical psychologist Lissa Johnson

What Makes Them Tick: Inside The Mind Of The Abbott Government concludes: “

The two ideals most dear to our Government’s extremist ideological heart could be exposed for what they are: change-aversion and inequality.

Inequality comes in many guises. Some are obvious to all; some are subtle.

Let’s take a contemporary example. The purpose of the Gonski schools reforms is to iron out inequality. Inequality of opportunity exists in schools that have many children from poorer postcodes or disadvantaged homes, where the children have disabilities or are of other than Anglo-Saxon ethnicity. These schools need extra resources. Despite the oft-repeated LNP mantra that the problem of inequality in schools cannot be solved ‘by throwing money at it’, the undeniable fact is that money

is needed for the extra teachers and teaching resources required. Notwithstanding that, the latest LNP ploy is to suggest that poorer outcomes might result when funding is increased! It’s all about avoiding properly funding years five and six of Gonski. Add to this the Turnbull suggestion that the federal government might focus on funding private schools and leave states to find the funds for public schools, and you have a recipe for deepening inequality. The well-funded private schools where the wealthy send their kids will leave the poorer schools further behind.

Voters are sick and tired of the LNP attitude to Gonski, which Abbott gave the impression he endorsed (we are on a unity ticket with Labor on education) before the 2013 election, only to walk away from properly funding it afterwards. They are sick and tired of the inequality of opportunity at public schools and the politicisation of school funding. It’s not fair and they want it fixed.

In the last few days we heard that in the tertiary sector student loans debt in Australia will likely top $185 billion in the next decade, much of it irrecoverable because graduates will not reach the income threshold where repayment of their loans begins. The reason they will not earn enough is that the courses they took did not qualify them sufficiently. Why? Because they were shonky courses, run by shonky operators, whose prime objective was to line their own pockets. They had no concern for course quality or outcome. Making money was their aim. They are crooks that have accentuated inequality. They prospered from students’ fees, which were borrowed from HELP. The students have nothing to show at the end except a massive debt, which the LNP is now threatening to retrieve from the student’s family, and even from deceased estates.

Education will be a hot issue at this election.

If you’re interested in seeing how good education might be delivered, in how excellent healthcare might be provided, in how women might contribute to good governance, be sure to see Michael Moore’s most recent brilliant film:

Where to Invade Next. You will be astonished.

Next, take the recent scandal revealed by the leak of the

Panama Papers. Here we have a flagrant example of the rich and powerful ferreting away their wealth in tax havens to avoid paying their fair share of tax. Presidents, prime ministers, politicians, sheiks, and thousands of wealthy individuals and businesses are implicated, 800 from this country. Some may have legitimate reasons for having assets overseas, but many are deeply suspect. Why does, for example, Wilson Security, which guards the ATO, have a need to open an account with Mossack Fonesca?

PAYE workers have no option but to pay their legal share of tax: the wealthy have the means of minimising it, or avoiding it altogether.

The ATO reported recently that almost 600 of the largest companies operating in Australia did not pay income tax in the 2013-14 financial year. Many are household names: Qantas, Virgin Australia, General Motors, Vodafone, ExxonMobil, Warner Bros Entertainment, Lend Lease and Ten Network Holdings. Others made huge profits but paid miniscule tax: Apple, Microsoft, Google, VW and Spotless.

That’s not fair. That’s inequitable. The voters are sick and tired of unfairness. And yet the Turnbull government is contemplating giving business a company tax break!

As if that’s not enough to turn our stomachs, we now have our most prestigious banks behaving like shonky back room operators. We have our most prominent bank, the Commonwealth Bank, employing loans traders who put their bonuses ahead of their clients’ welfare, invested clients’ funds in dubious schemes, thereby losing their life’s savings. We heard about claims managers in CommInsure who refused or unreasonably held up legitimate claims in order to bolster their bonuses. Then we heard that ANZ and Westpac harbour BBSW traders who have knowingly rorted the bank bill swap rates to make massive profits for their banks.

It’s wrong, it’s unfair, and we are fed up. What sort of unethical behaviour, what kind of culture allows such shonky practices in our most prestigious institutions? Yet when this unseemly culture was questioned, we heard a very senior banker, David Murray, ex-CEO of CBA, angrily castigating those who questioned it.

Take a look.

And while the top brass in the banks allow this toxic culture to develop and thrive, they are pocketing millions in salaries, bonuses and shares.

There are now calls for a Royal Commission into Banking, from Labor and the Greens, and even some Nationals who are angry about how some of their rural constituents have been treated by the banks. But there has been a noticeable lack of enthusiasm shown by the Liberals, who insist that ASIC can deal properly with the rorts, the corruption, the unfair behaviour. Yet they haven’t. Some regard it as useless!

Some Liberals have labelled calls for a Royal Commission as a ‘stunt’, and the bankers are up in arms – they’ve had enough enquiries they say! What a contrast this is to the relish with which the LNP pursued the unions via the Heydon Royal Commission into Union Governance and Corruption? Maybe the growing community sentiment will pressure government to establish a Royal Commission into Banking Governance and Corruption. Wouldn't that be nice!

Not long ago we heard of the corruption in NSW through its Independent Commission Against Corruption, ICAC. Countless politicians were shown to have their noses in the trough, ruthlessly exploiting the advantages of their positions. Many were forced to resign. The people are angry and fed up.

Only a week or two ago it was revealed that an elaborate mechanism had been set up to funnel donations from banned donors to the Liberal Party in NSW via the ‘Free Enterprise Foundation’. Key figures feigned ignorance, but the Liberals, having been caught out, were embarrassed. Key figures feigned ignorance, but the Liberals, having been caught out, were embarrassed. The NSW Electoral Commission is withholding some $4 million due to the NSW Liberal Party until it reveals its list of donors.

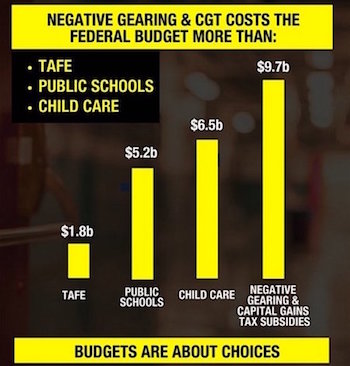

Reflect now on housing affordability. Young people, (and their parents), despair of ever owning their own home because competition from investors and the well-off using negative gearing to acquire a second or third dwelling are pushing house prices ever upward, so that now in Australia and particularly Sydney we arguably have the most unaffordable housing in the world.

The people want something done about negative gearing and the associated capital gains tax concessions. Labor has promised to do so and save the billions of revenue lost. The LNP, after talking about it, seems to have backed off.

Think too about the superannuation tax concessions enjoyed particularly by the very wealthy, who are able to deposit large sums into their fund for their retirement with minimal tax implications, a privilege not enjoyed by the poorer. Inequality again. Ordinary people want to see these perks for the wealthy, which cost the government billions in lost revenue, reduced or removed.

All these examples illustrate how those with wealth and those who have influence, those enjoying the view from the top of the tree, put themselves ahead of those beneath them, those they are supposed to serve. They prosper and profit while the rest languish and the inequality gap widens and widens.

Whichever way we turn we see this. More than ever the ordinary people are waking up to the reality of inequality, are angry about it, and are incensed by the reluctance of politicians to acknowledge and address it. They are fed up with unfairness, and want something done about it now.

They want the crooks, the shonky operators, the corrupt, and those responsible for the inequality brought to heel and punished. They have had enough. They want the system cleaned up. They want change!

Any politician guaranteeing to do so will get their support at the ballot box; those who don’t or won’t will be ignored.

Inequality will be a hot button issue at the upcoming election.

What do you think?

What are your views about inequality in this country?

What do you want done about it? What party is likely to act?

We look forward to reading your views and your comments.

For Facebook users, we have a Facebook page:

Putting politicians and commentators to the verbal sword – ‘Like’ this page to receive notification on your timeline of anything we post.

There is also a personal Facebook page:

Ad Astra’s page – Send a friend request to interact there.

We also have twitter accounts where we notify followers of new posts:

@1TPSTeam (The TPS Team account)

@Adastra5 (Ad Astra’s account)

Current rating: 0.3 / 5 | Rated 15 times