-

8/06/2016

-

Ad astra

-

Cormann

You all know what that idiomatic expression means – being tricked into buying something that is worthless. It arose from the old swindle of selling a bag that purportedly contained a piglet, but instead there was a puppy inside.

PM Turnbull wants you to believe that his bag contains a piglet, but all you will find is a pup. The piglet is called ‘Jobs and Growth’. Every day, many times every day, he is out there on the streets crying ‘Jobs and Growth’, ‘Jobs and Growth’, ‘Jobs and Growth’, like a door-to-door snake oil salesman.

The piglet that Turnbull says he has in his bag sounds attractive. Who would deny the benefit of more jobs? And only a nihilist would eschew the notion of growing the economy.

Trouble is that he won’t let you peep inside to check out the piglet. And he won’t tell you where he got it. He doesn’t want you to know its bloodline, whether or not it’s diseased, and whether it's able to do what piglets do best.

He wants you to buy his ‘Jobs and Growth’ piglet sight unseen; he does not want you to question its soundness.

How does he intend to feed his Jobs and Growth piglet? He says he will feed it with tax cuts for businesses, not just small businesses that we are told are the life blood of our economy and the leading employer of our workers, but also large businesses right up to multinational corporations, owned mainly by overseas investors.

How does he know that feeding the Jobs and Growth piglet with tax breaks will make it develop into a fat and succulent pig? Well, he has a theory.

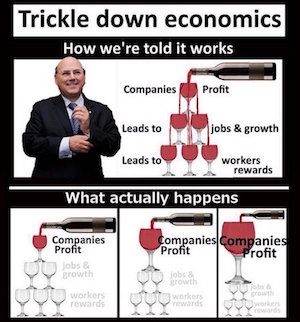

It goes like this: cut taxes to businesses and they will use the extra money in their pockets to expand their business, produce more, and employ more. That’s it! Turnbull didn’t invent it, nor did his daleks Treasurer Morrison or Finance Minister Cormann. It’s been around a long while. It goes by the name ‘Supply-side economics’. If you want to learn more about its origins and

modus operandi read this detailed account in

Wikipedia, which begins:

“Supply-side economics is a macroeconomic theory which argues that economic growth can be most effectively created by investing in capital, and by lowering barriers on the production of goods and services.

“According to supply-side economics, consumers will then benefit from a greater supply of goods and services at lower prices; furthermore, the investment and expansion of businesses will increase the demand for employees and therefore create jobs. Typical policy recommendations of supply-side economists are lower marginal tax rates and less government regulation.”

You’ve heard about lower marginal tax rates and less government regulation before, and how the benefits of these measures will trickle down to those at the bottom of the pile. We’ve written about: ‘Trickle down economics’ on

The Political Sword’. Its original name, coined by economist John Kenneth Galbraith, was: ‘Horse and sparrow economics’ – “

If you feed enough oats to the horse, some will pass through to the road for the sparrows.” Read

The trickle down effect by 2353NM,

How the economic rationalists tried to steal our hearts and minds by Ken Wolff, and

Trickle down economics breeds inequality by Ad astra.

Turnbull’s propositions might sound plausible to the casual observer, but does supply-side economics do what its proponents insist it does? Does it work? Is Turnbull’s Jobs and Growth piglet capable of developing into a large edible pig?

This question is not one that conservatives intend to address, although there is plenty of evidence that might provide an answer. They have an extraordinary capacity to ignore evidence. In an article in

Alternet, Noam Chomsky quotes political scientist Norman Ornstein’s description of the fervently conservative US Republican Party: “

…a radical insurgency that doesn’t care about fact, doesn’t care about argument, doesn’t want to participate in politics, and is simply off the spectrum.” Here we have the Liberal Party – same mind-set.

So does supply-side economics work? We have written often about the fallacy of trickle down economics, (see above) but there is much more. Sometimes you hear this economic theory described as ‘Reaganomics’ or ‘Thatcher economics’.

Let’s start with a blistering critique of Reaganomics, or ‘Riganomics’ as she prefers to call it, by Rachel Maddow, an American television host, political commentator and author who hosts a nightly television show,

The Rachel Maddow Show, on

MSNBC. The critique is titled:

How Reaganomics Destroyed The Middle Class...And Maybe America. It’s worth watching the whole 8 minutes 26 seconds of this YouTube clip:

If that hasn’t convinced you of the fallacy of supply-side or trickle down economics,

read this appraisal in Wikipedia. Part of the theory, which some describe as ‘voodoo economics’, posits that rather than federal revenue falling when tax cuts are made, it would rise, as portrayed by the mythical

Laffer curve,

debunked long ago. The theory is refuted here:

”Economist Gregory Mankiw used the term "fad economics" to describe the notion of tax rate cuts increasing revenue in the third edition of his Principles of Macroeconomics textbook in a section entitled "Charlatans and Cranks":

“An example of fad economics occurred in 1980, when a small group of economists advised Presidential candidate, Ronald Reagan, that an across-the-board cut in income tax rates would raise tax revenue. They argued that if people could keep a higher fraction of their income, people would work harder to earn more income. Even though tax rates would be lower, income would rise by so much, they claimed, that tax revenues would rise.

“Almost all professional economists, including most of those who supported Reagan's proposal to cut taxes, viewed this outcome as far too optimistic. Lower tax rates might encourage people to work harder and this extra effort would offset the direct effects of lower tax rates to some extent, but there was no credible evidence that work effort would rise by enough to cause tax revenues to rise in the face of lower tax rates…

“People on fad diets put their health at risk but rarely achieve the permanent weight loss they desire. Similarly, when politicians rely on the advice of charlatans and cranks, they rarely get the desirable results they anticipate. After Reagan's election, Congress passed the cut in tax rates that Reagan advocated, but the tax cut did not cause tax revenues to rise.”

Writing in

Business Insider Australia, about the US economy in an article titled

BOMBSHELL: New Study Destroys Theory That Tax Cuts Spur Growth, Henry Blodget says:

“One economic theory has been repeated so often for so long in this country that it has become an accepted fact: Tax cuts spur growth. Most Americans have gotten so used to hearing this theory that they don’t even question it anymore.

“One of our two Presidential candidates is so convinced of the theory that he has built his entire economic plan around it, despite the huge negative impact additional tax cuts would likely have on our debt and deficit.

“But is the theory true? Do tax cuts really spur growth?

“The answer appears to be “No.”

“According to a new study by the Congressional Research Service (non-partisan), there’s no evidence that tax cuts spur growth.

“In fact, although correlation is not causation, when you compare economic growth in periods with declining tax rates versus periods with high tax rates, there seems to be evidence that tax cuts might hurt growth…

“One thing that tax cuts do unequivocally – at least tax cuts for the highest earners – is increase economic inequality. Given that economic inequality is one of the biggest problems we face in this country right now, this conclusion is very important…

“…this topic has become highly politicized, so it’s impossible to discuss it without people howling that you’re just rooting for a particular political team. Second, no one likes paying taxes. Third, everyone would like a tax cut, including me.

“So I think we can all agree that everyone would prefer that tax cuts actually did spur economic growth.

“Alas…”

Blodget goes on to prove his point with a number of charts.

He asks:

“So, have these declining tax rates for the rich – the ‘job creators’ who are being given a bigger incentive to invest by the reduced tax rates led to faster economic growth?

“Nope.”

Later he says:

“Although tax cuts do not appear to spur economic growth, they DO appear to lead to greater economic inequality. Inequality in the United States recently hit a level that has not been seen since the 1920s: The country’s top earners are taking home more of the national income than at any time in 70 years.”

Referring to his charts, he says:

“And now let’s look at the correlation between this rise in inequality and tax rates – the lower the top marginal rates go, the bigger the share of national income that goes to the top 0.1% of wage earners. And it’s the same for capital gains rates.

“Meanwhile, the share of national income that goes to “labour”– a.k.a., most Americans – goes up as the top tax rates increase.

“Why is the rise in inequality so troubling? Well, beyond the issues of fairness and stability, increasing inequality is hurting the economy. Unlike middle class and upper middle class folks the country’s highest earners don’t spend all the money they earn. So this money doesn’t get circulated back into the economy, where it can become revenue for other companies and salaries for other workers. (If there were a dearth of investment capital, the money might get invested, but we’ve got plenty of investment capital right now. Our problem is a lack of demand).

“So, what’s the bottom line?

“Well, the bottom line appears to be that low taxes do not spur economic growth and DO cause greater economic inequality.

“So, although it sounds like heresy, presidents and Congress-people who actually want to fix the economy might want to consider raising taxes rather than cutting them. Or, at the very least, keeping them the same.”

You can read

the whole article here.

Along with tax cuts for businesses, Dalek Morrison keeps repeating that we don’t have a revenue problem, only a spending problem! He and Dalek Cormann are programmed to say this mindlessly and endlessly. The unavoidable consequence is spending cuts, which also go by the name ‘austerity’. Austerity has been tried in many places with little success.

An article in the Australian edition of

The Guardian by Larry Elliott,

Austerity policies do more harm than good, IMF study concludes, subtitled:

Economists give strong critique of neoliberal doctrine ushered in by Ronald Reagan and Margaret Thatcher in the 1980s begins:

“A strong warning that austerity policies can do more harm than good has been delivered by economists from the International Monetary Fund, in a critique of the neoliberal doctrine that has dominated economics for the past three decades.”

In response to the UK Chancellor of the Exchequer George Osborne’s wish to introduce austerity measures

“…to give the government more flexibility in the event of a future crisis”, IMF economists:

“…rejected the notion that austerity could be good for growth by boosting the confidence of the private sector to invest. They said that in practice, ‘episodes of fiscal consolidation have been followed, on average, by drops rather than by expansions in output. On average, a consolidation of 1% of GDP increases the long-term unemployment rate by 0.6 percentage points.’

“The IMF economists summarised what a growing consensus among economists across the globe now think, that Osborne-style austerity economics increases inequality and instability, and undermines growth.”

They concluded:

“…that the increase in inequality threatened to be self-defeating.

“The increase in inequality engendered by financial openness and austerity might itself undercut growth, the very thing that the neoliberal agenda is intent on boosting. There is now strong evidence that inequality can significantly lower both the level and the durability of growth.”

In yet another article in

The Guardian: You’re witnessing the death of neoliberalism – from within, Aditya Chakrabortty quotes IMF research: “

The results, the IMF researchers concede, have been terrible. Neoliberalism hasn’t delivered economic growth – it has only made a few people a lot better off.”

It seems that if neoliberalism is not yet dead, it is moribund.

How much more evidence do we need to be convinced that Turnbull is selling us a pup? There is no Jobs and Growth piglet in his swag. What’s more, even if there were, it could not grow into the jobs and growth he promises every day. His much-vaunted ‘plan’ has no substance. Ken Wolff goes into this in his

TPS Extra piece:

What economic plan?

Turnbull’s Jobs and Growth promise will not, indeed cannot be achieved. The food he says he will feed his Jobs and Growth piglet: lower taxes for businesses and spending cuts, will not make it grow. Indeed all the evidence, gathered over fifty years, indicate that his food will not even keep his Jobs and Growth piglet going.

Instead, the opposite will occur – it will starve. There will be no more jobs, and growth will not occur. Inequality will increase.

The rich will get richer and the poor will languish waiting for the promised benefits that will never trickle down.

In fact, the piglet Turnbull is trying to sell us is a pup.

Why do Turnbull, Morrison, Cormann and fellow ministers fly in the face of the facts? Why do they persistently cling to supply-side economics, which has been discredited over and over again? Ornstein’s answer rings true: Neoliberals are

'a radical insurgency that doesn’t care about fact, doesn’t care about argument, doesn’t want to participate in politics, and is simply off the spectrum.’ They adhere to their preferred economic theory because it suits them and their top-end-of-town supporters, replete with

top hats.

How can we argue with such people? We can’t. The only way to destroy their dangerously flawed economics, which threatens not just our economy, but also the social fabric of this egalitarian nation of the ‘fair go’, is via the ballot box.

July 2 is our best chance to tell Turnbull that he is selling us a pup.

Current rating: 0.4 / 5 | Rated 13 times